Raising the Bar for Digital Banking in México

BBVA Bancomer (top 1 bank in México) engaged in a comprehensive benchmarking initiative to evaluate its competitive position across multiple digital and physical banking channels. The project assessed over 330 best practices and 90 strategic recommendations across 23 institutions, focusing on identifying market trends, gaps, and opportunities to strengthen BBVA’s leadership in Mexico’s banking sector.

The Challenge.

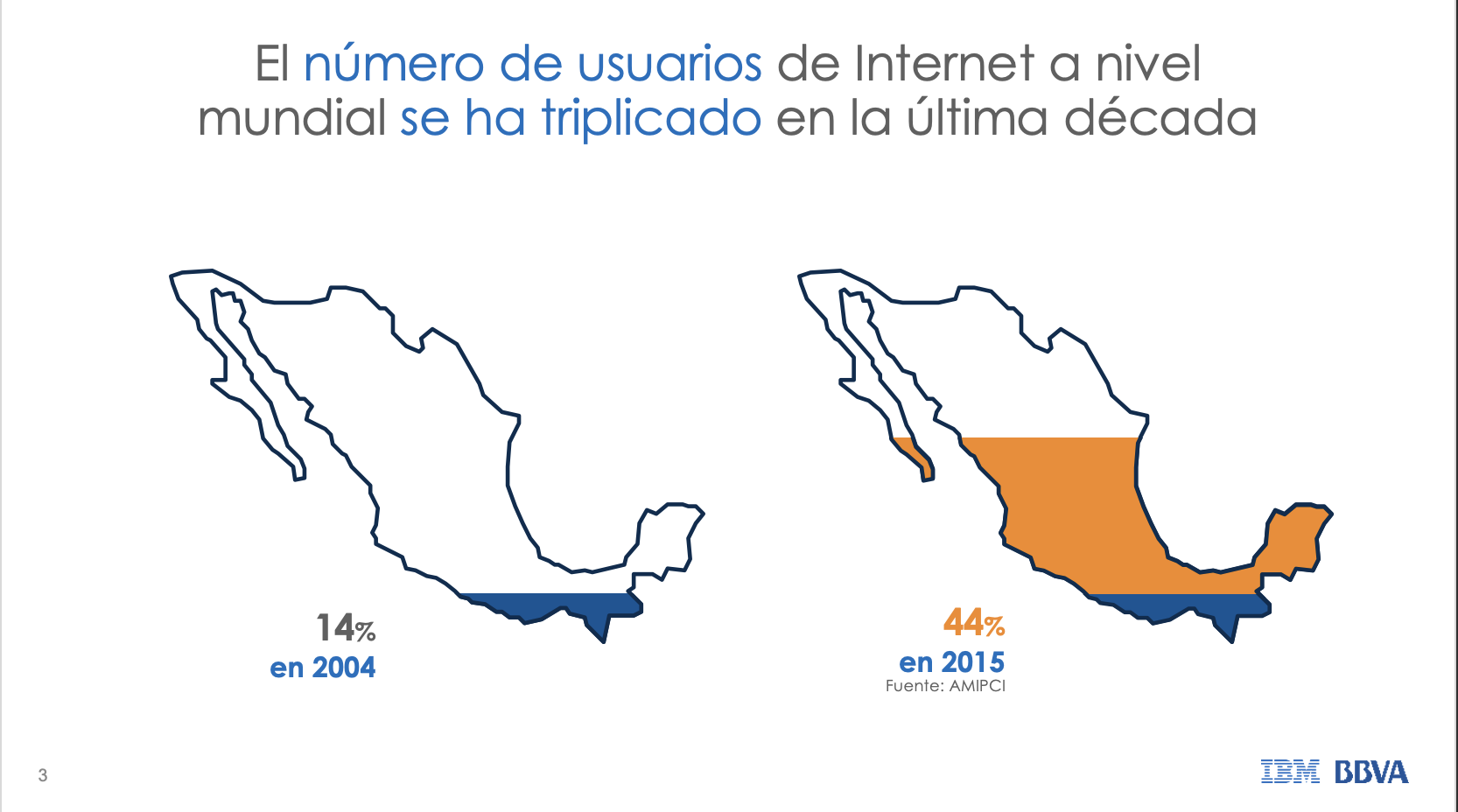

In a rapidly evolving financial landscape, customer expectations for seamless, secure, and innovative banking experiences have never been higher. As the largest bank in Mexico, with over 25 million clients and a market share exceeding 20%, BBVA operates at a scale where even minor inefficiencies or gaps can translate into significant operational costs, customer dissatisfaction, and potential loss of market leadership.

Despite its strong position, BBVA faced increasing competition from both traditional banks and digital-native players offering superior usability, speed, and personalization. Maintaining leadership required addressing potential weaknesses quickly, particularly in areas such as fraud prevention, omnichannel integration, and consistent user experience across digital and physical touchpoints.

Without a clear, data-backed view of its standing against national and international competitors, there was a risk of losing competitive advantage in key customer-facing channels.

A Data-Driven Approach to Competitive Benchmarking

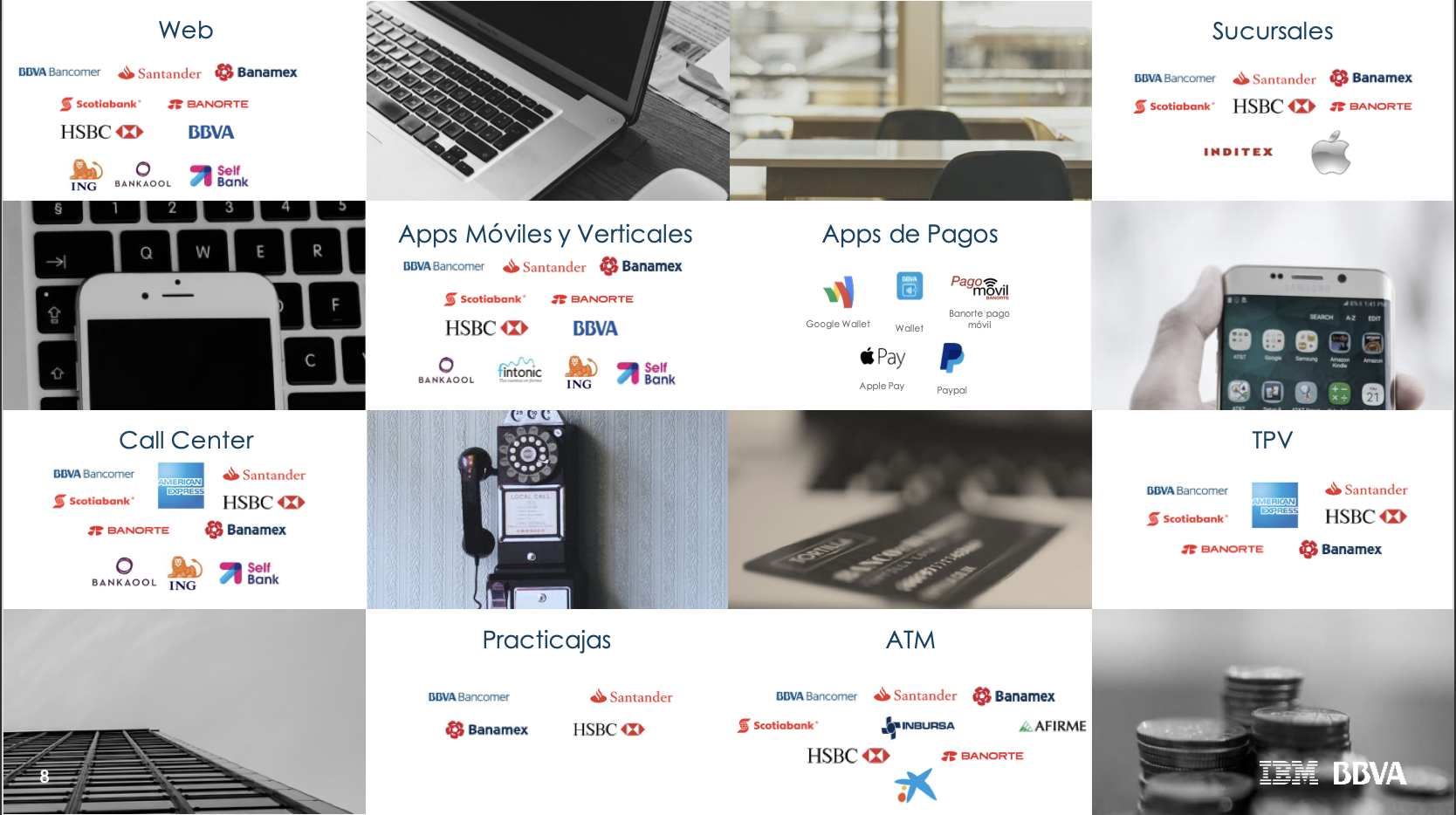

The benchmarking process analyzed BBVA’s performance across Web, Mobile Apps, Wallets, ATMs, Practicajas, Branches, Call Centers, and POS terminals, comparing them with industry leaders and global best practices.

Key activities included:

Channel-by-channel competitive analysis.

Evaluation of over 450 performance drivers.

Identification of representative user segments for realistic, high-impact improvements.

Prioritization of initiatives by strategic importance and feasibility.

Structuring Insights for Omnichannel Excellence

The study structured its evaluation using a multi-channel, multi-driver architecture, ensuring a holistic perspective. Each channel’s design and functionality was assessed for:

User Experience & Accessibility

Operational Functionality

Security & Trust

Omnichannel Integration

Product and Service Availability

This approach ensured that digital and physical touchpoints were evaluated not only in isolation but as part of an integrated ecosystem.

From Insights to a Strategic Roadmap for Digital Leadership

The outcome was a detailed roadmap of strategic recommendations per channel, including:

Implementing demo accounts and PFM (Personal Financial Management) tools in digital platforms.

Enhancing app usability with unified design, personalization, and biometric access.

Increasing paperless processes and promoting self-service in branches.

Enabling NFC-based ATM withdrawals and POS payments.

Strengthening omnichannel capabilities to ensure service continuity across web, mobile, and in-person channels.

Impact & Results

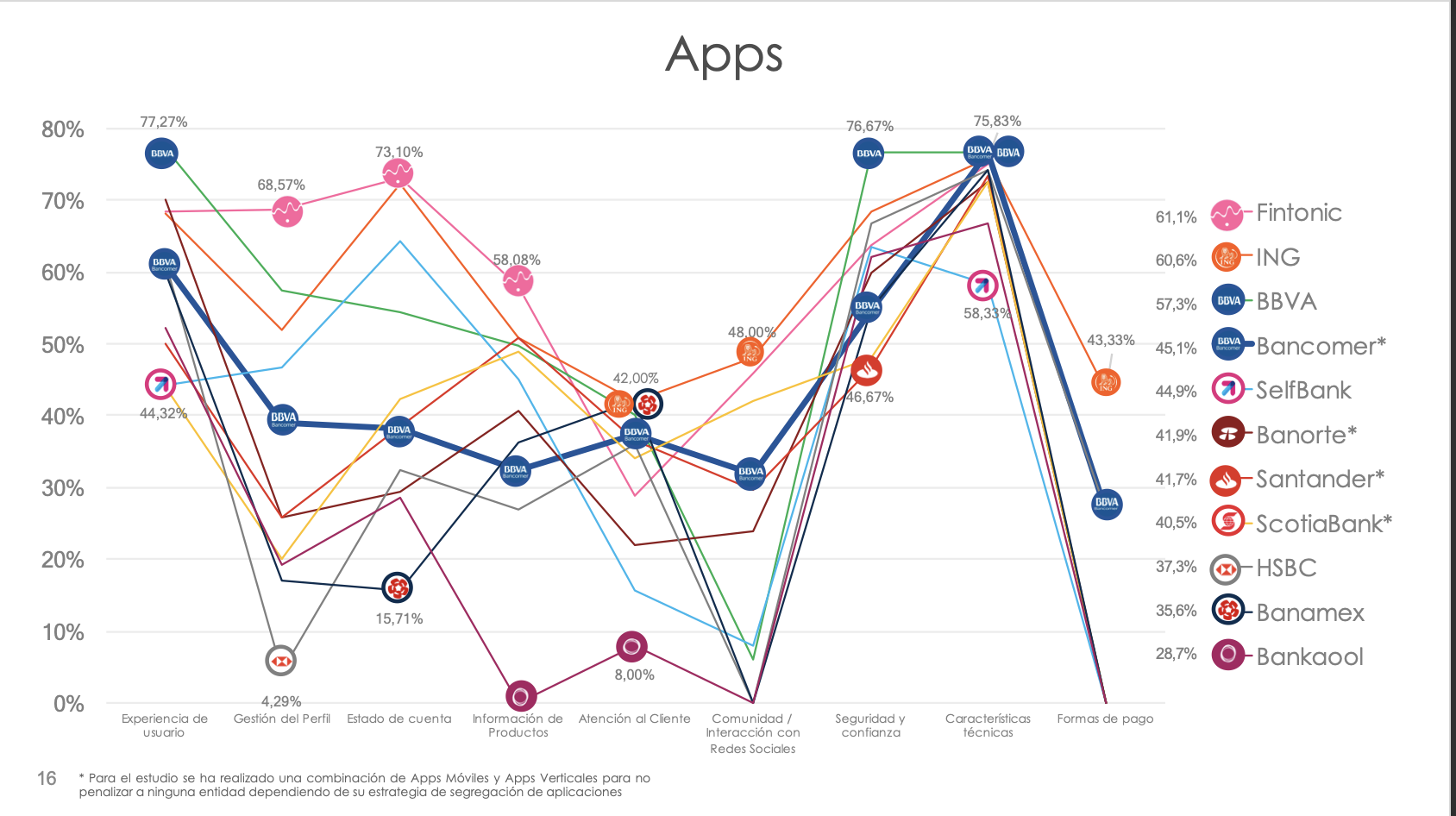

The benchmarking initiative provided BBVA with a clear, data-backed picture of its competitive position across the most relevant digital and physical banking channels in Mexico. By mapping its performance against 22 national and international competitors, the study revealed both BBVA’s strengths and the critical gaps that required immediate action.

Key outcomes included:

+90 prioritized, actionable recommendations to close performance gaps, enhance customer experience, and reinforce BBVA’s leadership position.

Identification of opportunities to match or surpass digital leaders such as Apple Pay, ING, and Fintonic in targeted functionalities.

A structured plan to enhance security, fraud prevention, and customer trust while maintaining a consistent experience across channels.

Roadmaps for innovating in high-impact touchpoints like mobile banking, digital wallets, and self-service kiosks.

Insights that enable strategic investments in technology and design to keep pace with the most advanced global banking experiences.

For a bank serving over 25 million customers in Mexico, these findings were not only an operational advantage—they became a strategic tool to future-proof BBVA’s competitive edge and ensure its position as the country’s digital banking leader.

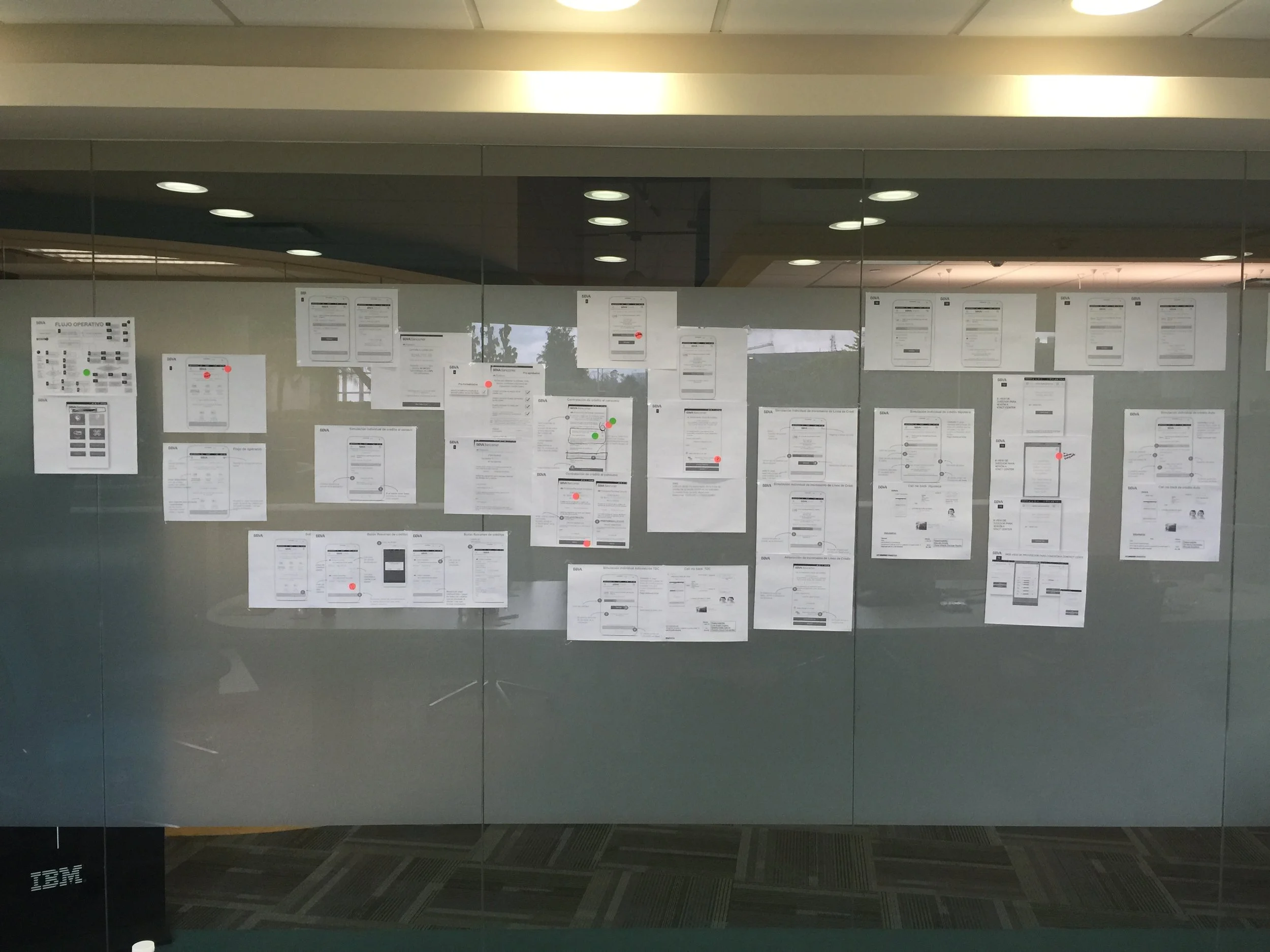

I led the strategy, analysis, and recommendations for BBVA’s multi-channel benchmarking, ensuring insights were transformed into clear, actionable roadmaps. Partnering with IBM Spain’s team, I directed cross-geography collaboration to integrate diverse expertise into a unified, global perspective.

I spearheaded the work of data collection teams, coordinating efforts to gather and validate information from hundreds of branches and ATMs nationwide. Simultaneously, I maintained direct engagement with BBVA’s C-level technology and business leaders to align objectives, refine priorities, and ensure full executive buy-in.

I defined the evaluation framework, covering critical channels—Web, Mobile Apps, Wallets, ATMs, Branches, Call Centers, and POS—and ensured alignment with BBVA’s digital transformation strategy. By overseeing the synthesis of hundreds of data points into strategic insights, I applied a user-centric approach that balanced customer experience, security, and operational efficiency.

Through this leadership, I guided the prioritization of quick wins and long-term initiatives, enabling BBVA to achieve immediate impact while strengthening its competitive position. The result was a scalable benchmarking model the bank can continuously leverage to monitor, adapt, and lead in Mexico’s banking sector.