AI Banking Breakthrough: Banorte’s Maya Assistant Redefining Customer Engagement

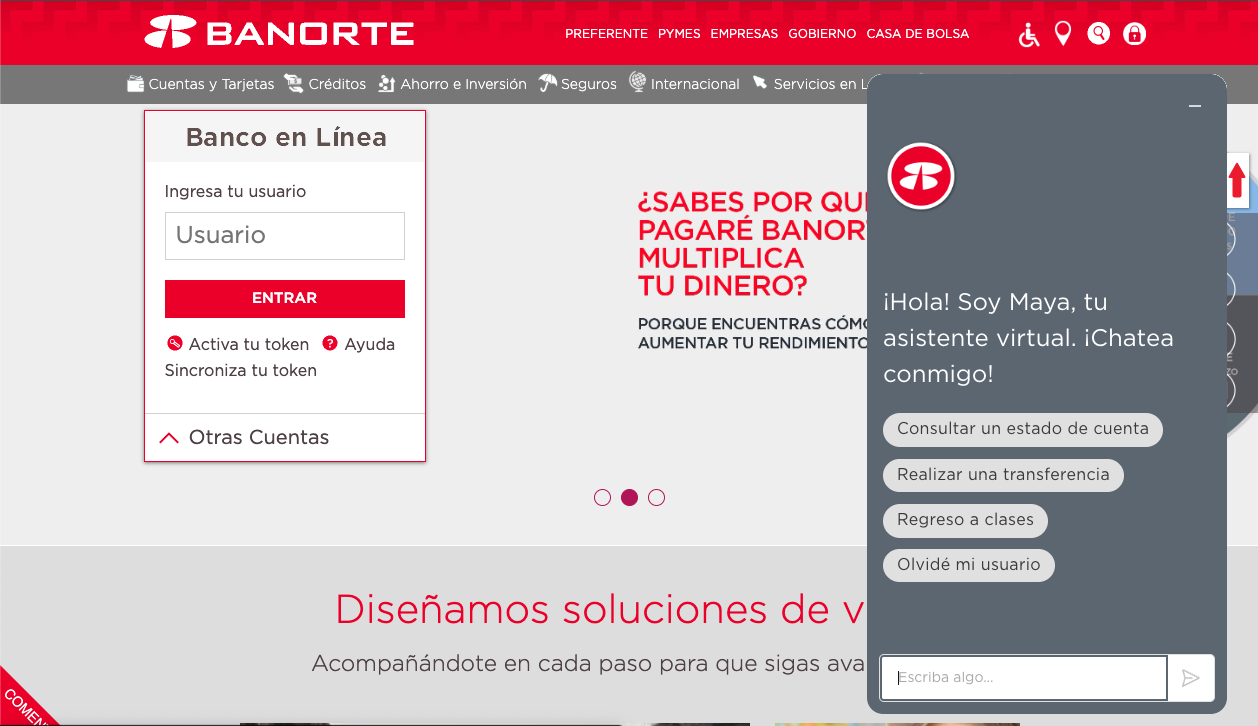

Reimagining how millions of customers connect with their bank, Maya—Banorte’s first-of-its-kind multichannel AI assistant—delivers speed, simplicity, and intelligence in every interaction. Whether on web, mobile, or through the contact center, Maya seamlessly bridges customers to the services they need, cutting wait times, streamlining transactions, and elevating satisfaction across every touchpoint.

The Challenge.

Banorte faced the challenge of managing millions of customer interactions across its contact center, web, and mobile channels—many of them repetitive, time-consuming, and resource-intensive. Customers expected faster, simpler, and more accessible service, while the bank needed to optimize operational efficiency without compromising quality. The vision was clear: create a solution that could understand natural language, provide accurate responses instantly, and seamlessly handle requests across multiple channels. Maya was conceived to meet this need—an AI-powered assistant capable of delivering personalized, efficient, and consistent service at scale, freeing human agents to focus on higher-value interactions.

Strategic Discovery for AI Innovation

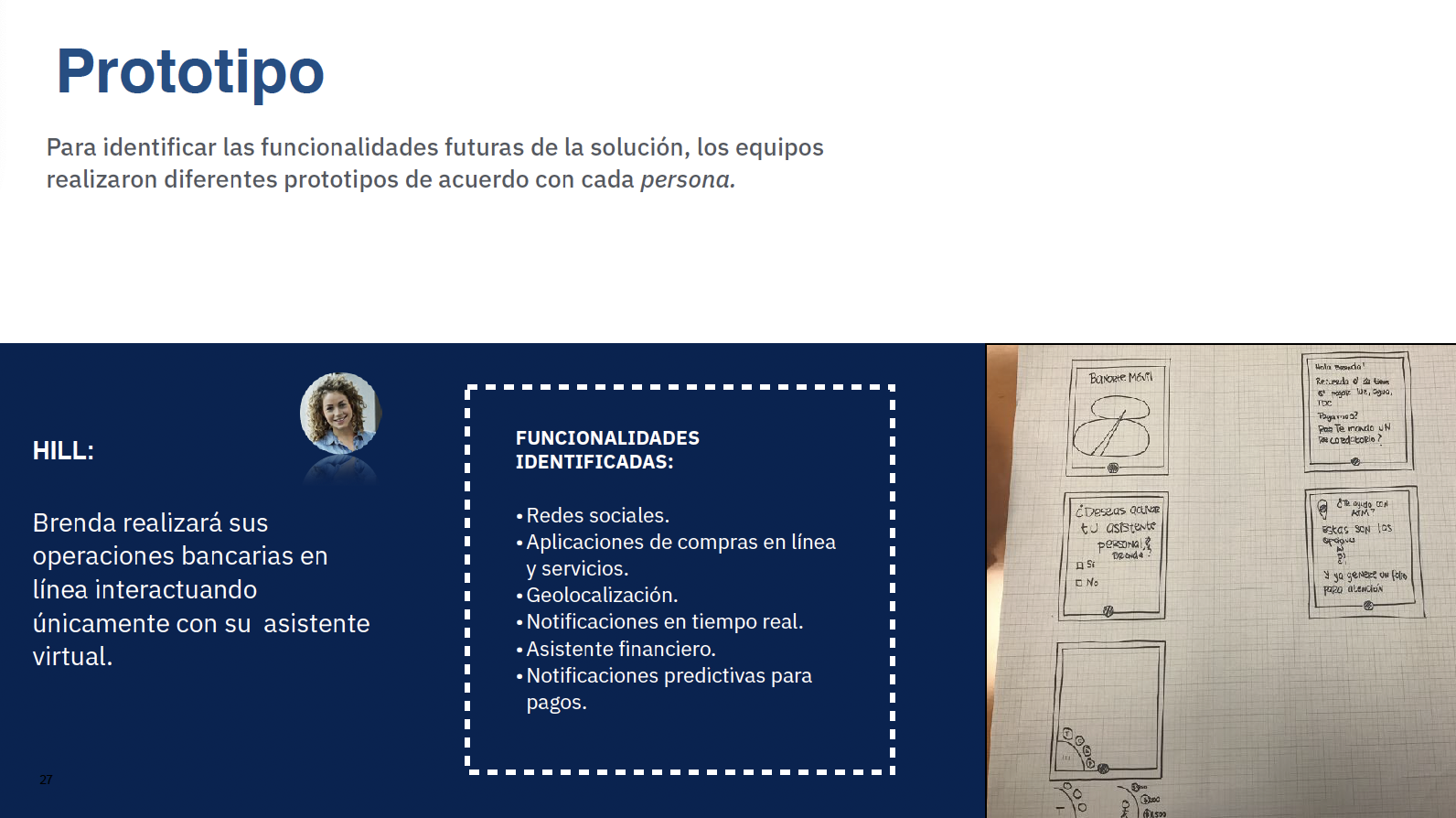

The path to Maya began with a close collaboration between our team and Banorte’s key stakeholders. We kicked off with a series of Discovery workshops using Design Thinking methodologies to deeply understand user needs, operational challenges, and the bank’s strategic objectives.

Through these sessions, we identified and refined strategic ideas, prioritizing them together with C-level and business leaders to ensure alignment with both customer expectations and organizational goals. This collaborative approach allowed us to define a clear vision for the AI assistant, ensuring it would not only meet immediate needs but also serve as a scalable foundation for future innovation in Banorte’s customer experience.

Customer-First, AI-Powered

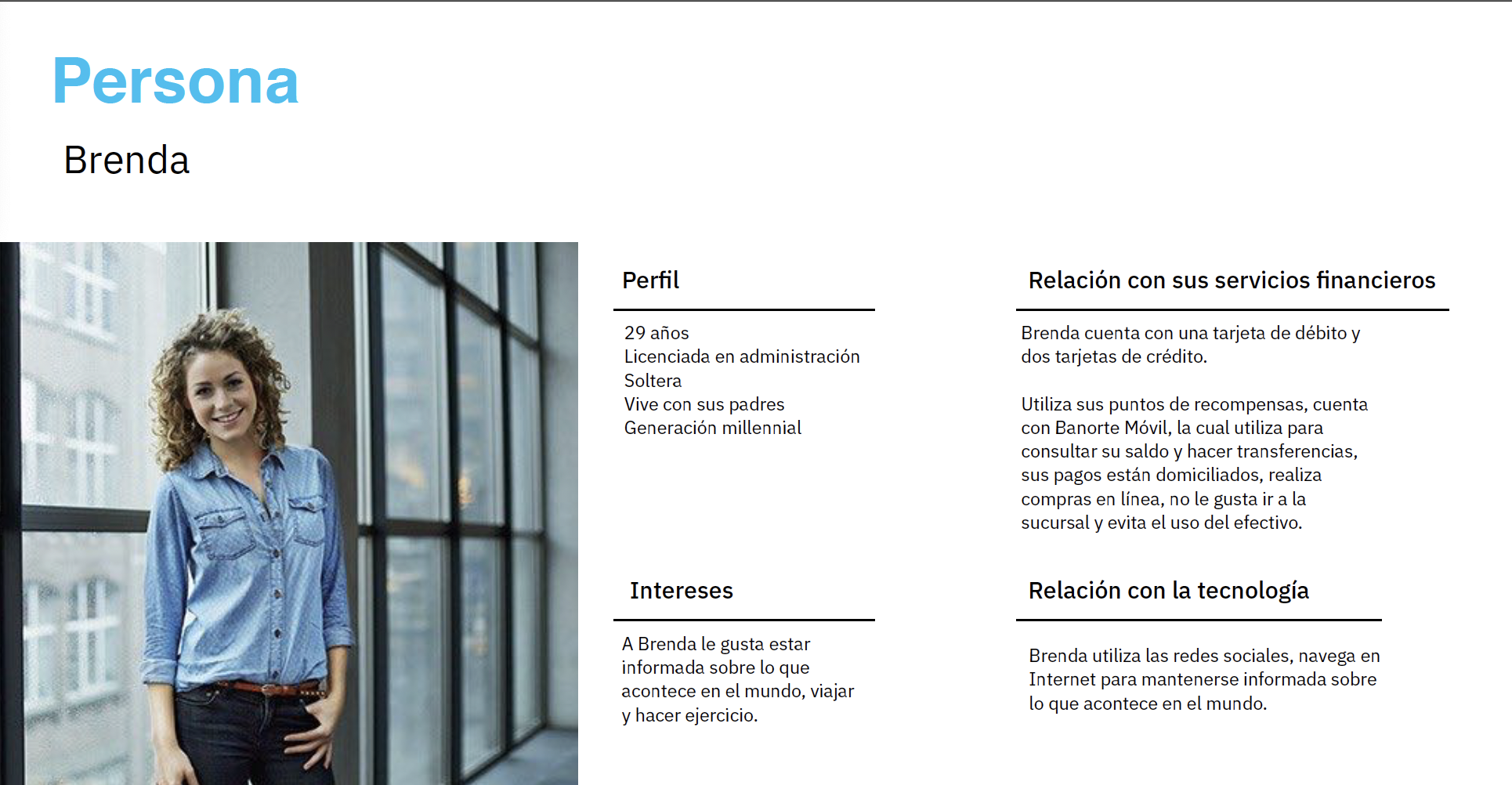

Understanding the real needs of Banorte’s customers was at the heart of shaping Maya. Through in-depth research, user journey mapping, and analysis of contact center data, we uncovered the most frequent requests, pain points, and service gaps impacting customer satisfaction.

This insight allowed us to prioritize an AI-driven, user-centric solution designed to address high-impact use cases first—resolving common inquiries instantly, reducing wait times, and providing consistent, personalized responses across channels. By focusing on what mattered most to customers, we ensured Maya would deliver immediate value while building trust in AI as a reliable service channel.

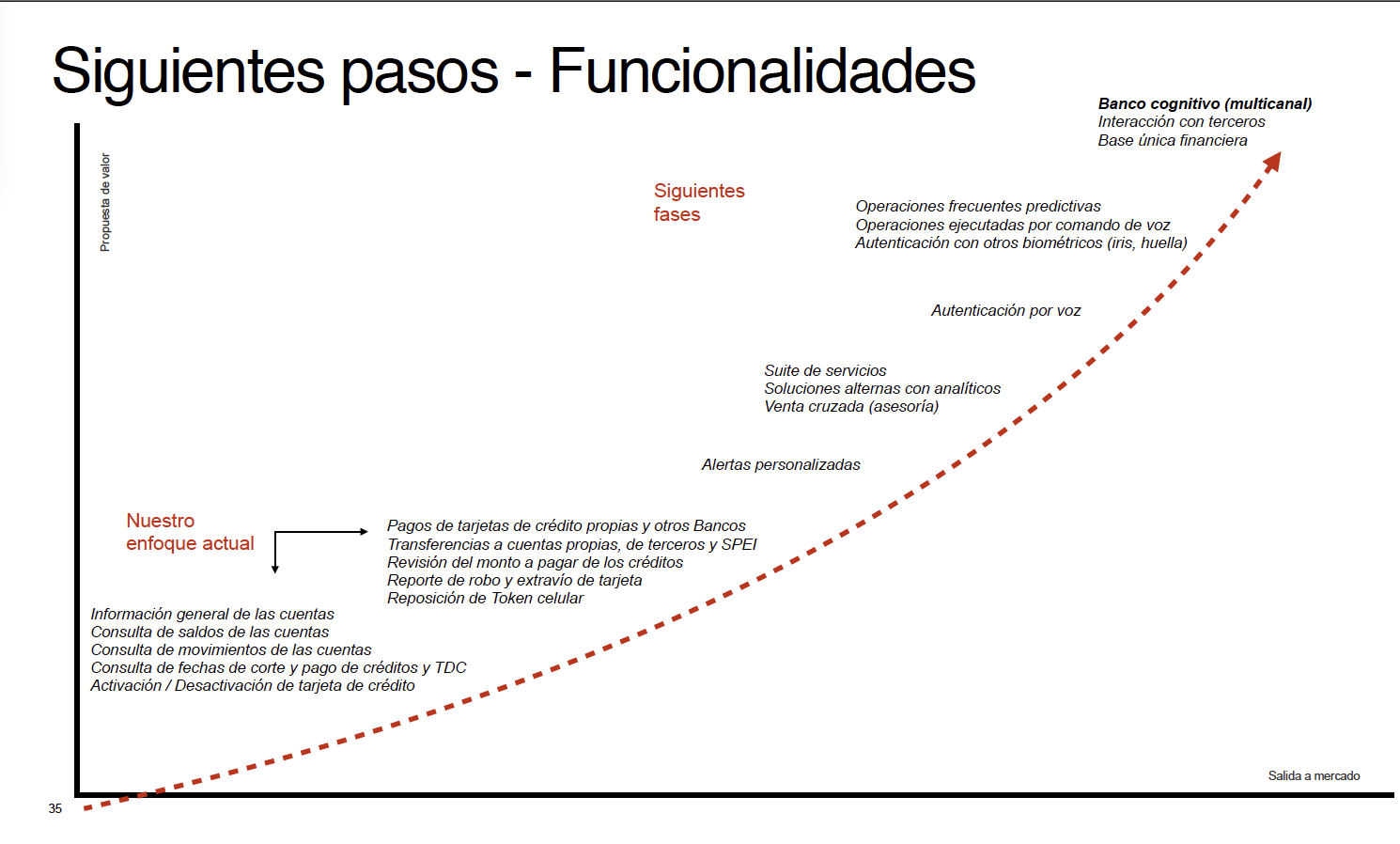

Building a Transaction-Ready, Multichannel AI

Maya was designed not just to answer questions, but to act. Built with secure transactional capabilities, the assistant enables customers to perform key banking operations—such as payments and transfers—directly within the conversation.

Available across web and mobile channels, Maya was architected with scalability in mind, ready for seamless integration with future touchpoints like voice assistants and social media platforms. This flexibility ensures Banorte can continue evolving customer engagement, meeting users where they are and delivering consistent, high-quality service across every channel.

Impact & Results

Maya quickly became a cornerstone of Banorte’s digital customer experience. The AI assistant now processes over 2.5 million messages each month, achieving a first-contact resolution rate above 90% and handling more than 28,000 transactions monthly across digital channels.

Beyond operational efficiency, Maya has elevated customer satisfaction by delivering fast, accurate, and reliable support at scale. Its success earned global recognition as one of the nine best AI innovations in banking, awarded by EFMA and Accenture—positioning Banorte as a leader in AI-powered banking solutions.

As Head of Product, I led the vision, strategy, and end-to-end delivery of Maya, orchestrating collaboration between Banorte’s stakeholders, design teams, engineers, and AI specialists. Leading a cross-functional, global team of over 50 professionals across multiple time zones ,I partnered closely with key bank divisions—including Digital Channels, Contact Center, Innovation, and IT—to ensure alignment and seamless execution. Together with the Marketing team, I helped define Maya’s branding, tone of voice, and personality to reflect the bank’s values and connect with customers.

This project represented a significant challenge as it was the first-of-its-kind AI banking assistant in Mexico, integrating IBM Watson’s capabilities with the bank’s core systems to deliver secure, scalable, and human-centered interactions. I facilitated Discovery and Design Thinking workshops to align business goals with customer needs, conducted focus groups to refine features and user interactions, defined the strategic roadmap, and prioritized high-impact use cases for launch.

I oversaw the design and development of Maya’s multichannel, transaction-ready capabilities, ensuring scalability for future integrations. My leadership guided the project from concept to recognition as one of the world’s top AI banking innovations—delivering measurable impact for both the bank and its customers.